Sources: IMARC Group (2024–2033); Future Market Insights (2025–2035); Mordor Intelligence (2025).

Note: Market size estimates for Europe’s refrigerated transport industry may vary depending on data scope and methodology. The USD 4.7 billion figure cited for 2024 is derived from reputable market research sources such as IMARC Group and Mordor Intelligence, which base their estimates on proprietary logistics and transport sector data modeling. Public statistical institutions like Eurostat and national agencies do not publish separate valuations for the refrigerated transport segment; their data typically aggregate broader freight and logistics indicators by mode or commodity. Therefore, while this figure is credible and widely recognized in industry analysis, it is not directly confirmed by Eurostat or national statistics and should be interpreted as a reliable industry estimate rather than an official government figure.

As Europe’s climate shifts, reliable temperature-controlled transport becomes more essential than ever

keeping goods safe, fresh, and sustainable.

How Climate Change Is Reshaping Europe’s Refrigerated Transport Market

Climate change is transforming how goods are moved across Europe. Rising temperatures, unpredictable weather, and stricter environmental regulations are redefining what it takes to deliver safely and sustainably. Operating across Spain, France, Germany, Italy, Hungary, Poland, Sweden, and the UK, we see first-hand how these shifts are influencing temperature-controlled transport.

In this article, we explore how these developments are reshaping temperature-controlled transport and what they mean for the future of the industry.

Climate Change & Rising Demand for Refrigerated Transport

Europe is facing more frequent extreme weather events such as floods, heatwaves, and droughts, which severely affect food production and supply chains. These disruptions heighten the need for reliable refrigerated transport to maintain the freshness and safety of perishable goods, from fresh produce to pharmaceuticals.

Growing consumer preference for high-quality, fresh food further drives demand, alongside the continued expansion of pharmaceutical cold chains to ensure the safe delivery of vaccines, biologics, and temperature-sensitive medicines.

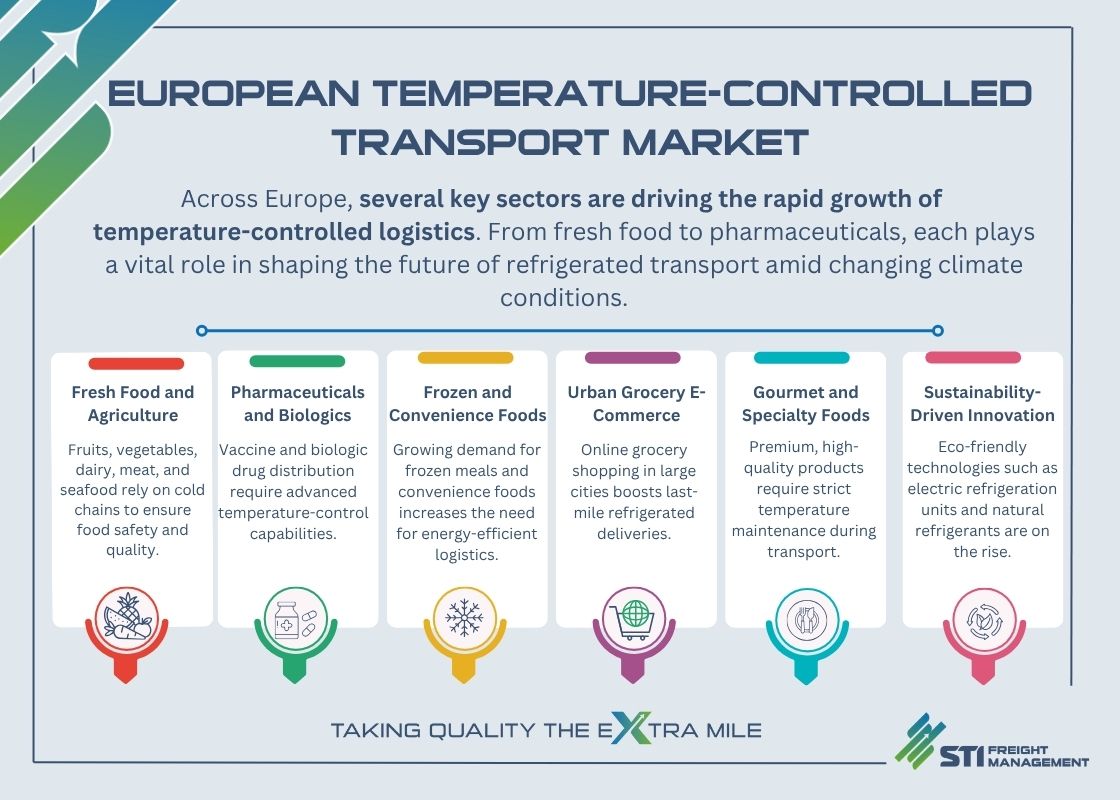

Growing Demand Across Key Sectors

The European refrigerated transport market reached approximately USD 4.7 billion in 2024 and is expected to grow at a CAGR of about 4.3% through 2033, driven by climate-related shifts affecting how goods must be preserved and delivered. The following sectors are the main drivers of this expanding market:

The European refrigerated transport market reached approximately USD 4.7 billion in 2024 and is expected to grow at a CAGR of about 4.3% through 2033, driven by climate-related shifts affecting how goods must be preserved and delivered. The following sectors are the main drivers of this expanding market:

- Fresh Food and Agriculture: This sector remains the backbone of refrigerated transport, encompassing fruits, vegetables, dairy, meat, and seafood. Climate change-induced temperature rises and erratic weather amplify spoilage risks, reinforcing the critical role of cold chains to ensure food safety, quality, and year-round availability.

- Pharmaceuticals and Biologics: The growing pharmaceutical cold chain, fueled by increased vaccine and biologic drug distribution, demands advanced temperature-control capabilities. The pandemic accelerated investment in this sector, which continues to grow as therapies become more temperature-sensitive.

- Frozen and Convenience Foods: As consumer demand for frozen meals and convenience foods rises, so does the need for energy-efficient, sustainable refrigerated logistics. Efforts to raise storage temperatures slightly are underway to reduce carbon footprints while maintaining product integrity.

- Gourmet and Specialty Foods: Emerging as a significant niche, this sector benefits from evolving consumer preferences for premium, high-quality products that require strict temperature maintenance throughout transport.

- Urban Grocery E-Commerce: The surge in online grocery shopping, especially in large European cities, has increased last-mile refrigerated deliveries. This creates new demands in urban logistics amid rising temperatures and dense city environments.

- Sustainability-Driven Innovation: Across sectors, there is a strong push toward eco-friendly technologies such as electrified refrigeration units, natural refrigerants, advanced insulation materials, and real-time temperature monitoring to meet stricter environmental regulations and reduce emissions.

Transport Modes & Technology

Road transport continues to dominate Europe’s refrigerated logistics market, accounting for roughly two-thirds of total market share thanks to its flexibility and extensive infrastructure.

At the same time, air freight is expanding its role—particularly in the pharmaceutical sector, where temperature precision and speed are essential. Sea and rail transport are also contributing, especially for cross-border trade and large-volume flows aligned with sustainability goals.

Technological innovations such as advanced insulation materials, real-time telematics, eco-friendly refrigerants, and electric refrigeration units are enhancing energy efficiency, reducing spoilage, and promoting greener cold chain operations across Europe.

Looking Ahead

As climate and market dynamics evolve, refrigerated transport will continue to demand innovation, precision, and shared responsibility. Drawing on our experience across Europe, we remain focused on advancing technology, sustainability, and service reliability—ensuring goods reach their destinations safely, efficiently, and with care. It’s how we continue to take quality that extra mile.

Road transport continues to dominate Europe’s refrigerated logistics market, accounting for roughly two-thirds of total market share thanks to its flexibility and extensive infrastructure.

At the same time, air freight is expanding its role—particularly in the pharmaceutical sector, where temperature precision and speed are essential. Sea and rail transport are also contributing, especially for cross-border trade and large-volume flows aligned with sustainability goals.

Technological innovations such as advanced insulation materials, real-time telematics, eco-friendly refrigerants, and electric refrigeration units are enhancing energy efficiency, reducing spoilage, and promoting greener cold chain operations across Europe.

Looking Ahead

As climate and market dynamics evolve, refrigerated transport will continue to demand innovation, precision, and shared responsibility. Drawing on our experience across Europe, we remain focused on advancing technology, sustainability, and service reliability—ensuring goods reach their destinations safely, efficiently, and with care. It’s how we continue to take quality that extra mile.